Us Tax Brackets 2025 For Tax Credits

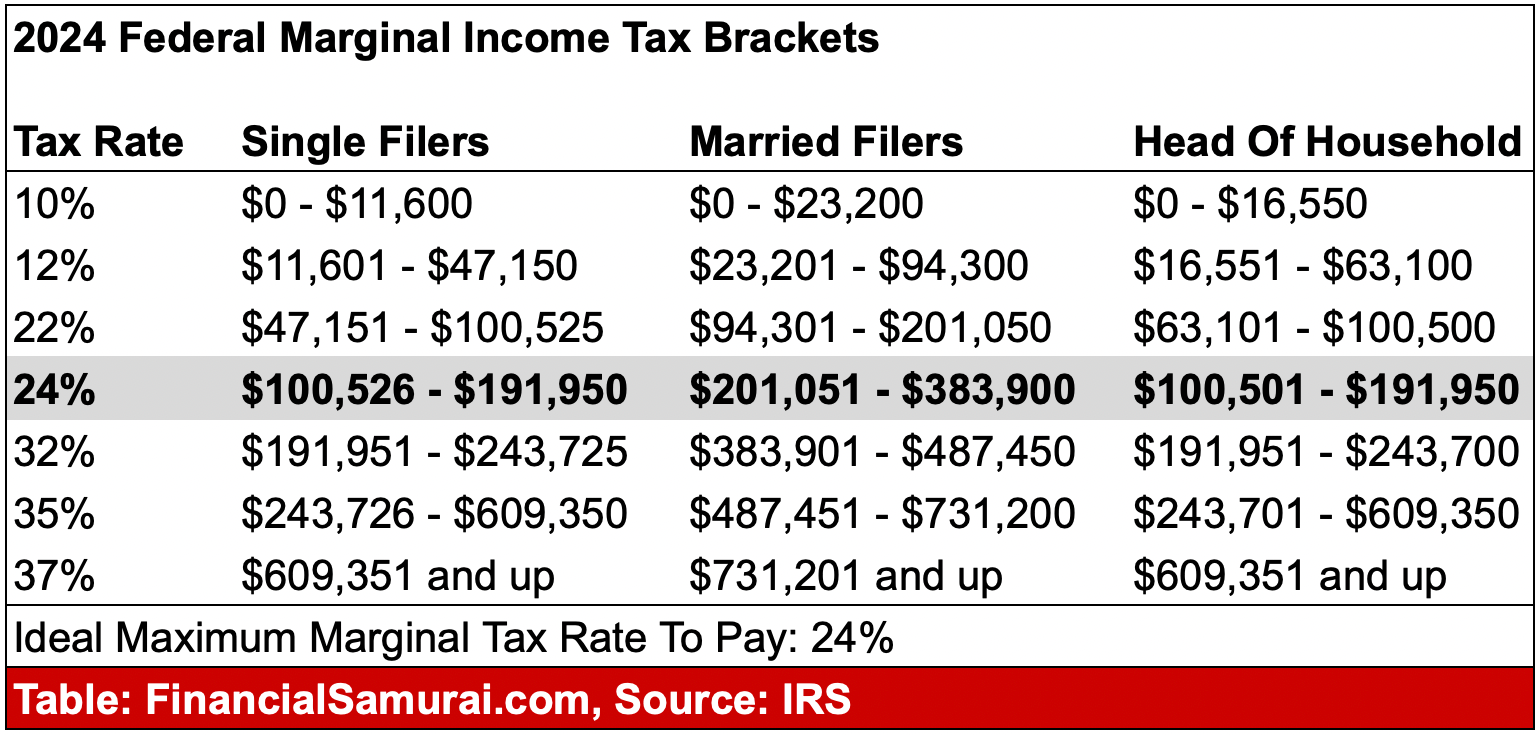

BlogUs Tax Brackets 2025 For Tax Credits. Discover the new federal income tax brackets for 2025, including updates on standard deductions and credits. The tax brackets for 2025 remain the same as the 2025 brackets at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The internal revenue service (irs) is responsible for publishing the latest tax tables each year, rates are typically published in 4 th quarter of the year proceeding the new tax year.

Tax Brackets 2025 2025 Mame Stacee, Here are the income phaseout amounts for claiming the eitc for tax year 2025 (typically filed in 2026).

Tax 계산 방법(간편 계산기 포함), See current federal tax brackets and rates based on your income and filing status.

A Guide to the 2025 Federal Tax Brackets Priority Tax Relief, Earned income tax credit (eitc).

IRS Tax Brackets 2025, Federal Tax Tables, Inflation Adjustment, The tax brackets are divided into income ranges, and each range is taxed at a different percentage.

Tax Brackets 2025 Single Calculator Penny Blondell, Your bracket depends on your taxable income and filing status.

Tax Brackets For 2025 Tax Year Usa Brenn Martica, Learn how these changes can impact your tax situation and.

Tax Brackets For 2025 Tax Yearth Academy Mora Tabbie, The tax brackets for 2025 remain the same as the 2025 brackets at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Brackets For 2025 Tax Yearth Athene Karine, Keep in mind that the adjustments below apply to income tax returns that you’ll file.

2025 Tax Brackets Married Jointly Vs Single Dedie Eulalie, The federal income tax has seven tax rates in 2025: